All Categories

Featured

Table of Contents

[/image][=video]

[/video]

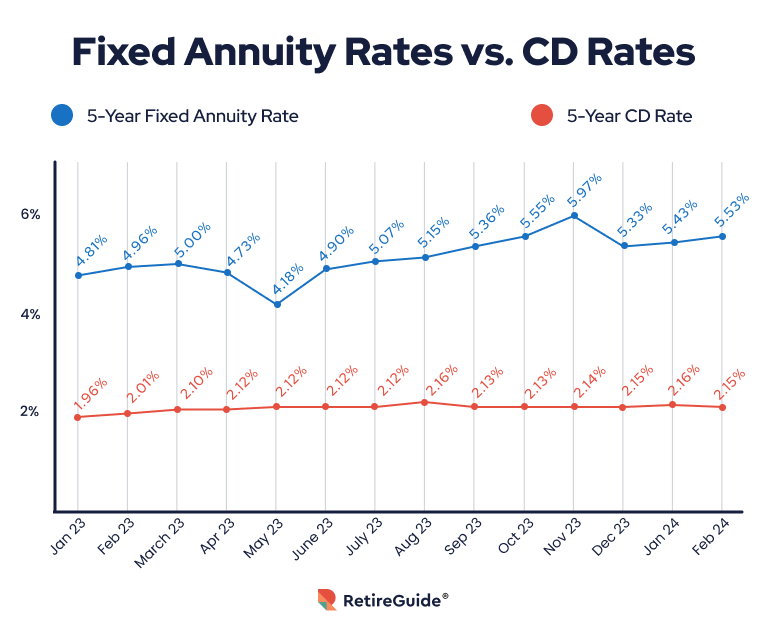

But the landscape is changing. As rates of interest decrease, fixed annuities might lose some appeal, while items such as fixed-index annuities and RILAs gain traction. If you're in the marketplace for an annuity in 2025, shop thoroughly, compare alternatives from the ideal annuity business and focus on simplicity and openness to find the best fit for you.

When selecting an annuity, monetary strength ratings issue, but they don't inform the entire tale. Here's how contrast based on their scores: A.M. Best: A+ Fitch: A+ Requirement & Poor's: A+ Comdex: A.M. Ideal: A+ Fitch: A+ Moody's: A1 Standard & Poor's: A+ Comdex: A.M. Finest: A+ Moody's: A1 Criterion & Poor's: A+ Comdex: A greater monetary rating or it only mirrors an insurer's monetary toughness.

If you focus just on rankings, you may The ideal annuity isn't simply about business ratingsit's about. That's why comparing real annuity is a lot more vital than simply looking at economic toughness scores.

That's why it's necessary to get recommendations from a person with experience in the market. is an staffed by independent certified financial professionals. We have years of experience assisting individuals discover the right products for their demands. And because we're not associated with any kind of business, we can offer you honest recommendations about which annuities or insurance coverage are appropriate for you.

We'll help you sort with all the choices and make the best choice for your situation.

And keep in mind,. When it pertains to taken care of annuities, there are numerous choices out there. And with many options, recognizing which is ideal for you can be challenging. Yet there are some points to search for that can help you tighten down the field. Initially, select a highly-rated firm with a strong credibility.

Guardian Annuities

And lastly, choose an annuity that is understandable and has no tricks. By following these standards, you can be certain you're getting the very best feasible offer on a taken care of annuity.: Oceanview Annuity due to the fact that they tend to have higher rate of interest with conventional liquidity. ("A" ranked annuity company): Clear Springtime Annuity since they are straightforward, strong annuity rates and common liquidity.

Some SPIAs provide emergency situation liquidity features that we like. If you seek an immediate earnings annuity, consider fixed index annuities with a guaranteed lifetime earnings motorcyclist and begin the income promptly. Annuity owners will certainly have the flexibility to transform the retirement income on or off, access their savings, and be able to maintain up with inflation and earn passion while getting the earnings forever.

The best-indexed annuities will certainly offer the highest possible earnings and upside prospective while providing high protection for your financial savings. So, if you're searching for an option to aid you maximize your retirement revenue, an indexed annuity may be the appropriate choice.: North American's Income Pay Pro Annuity (A+ Rated) and Nationwide's New Heights Deferred Income Annuity (A+ Ranked): North American's BenefitSolutions Annuity (A+ Ranked) and North American's BenefitSolutions Annuity (A+ Rated) are great deferred income annuities.

Athene Agility offers the income base with a massive benefit (20%) paid out over a series of settlements at death, and there's no added price for this feature. There are a few crucial elements when looking for the very best annuity. Compare passion prices. A greater interest rate will offer more growth capacity for your financial investment.

This can promptly improve your financial investment, however it is necessary to comprehend the conditions connected to the perk before investing. Assume concerning whether you desire a lifetime earnings stream. This kind of annuity can provide assurance in retirement, yet it is vital to make sure that the earnings stream will certainly suffice to cover your requirements.

These annuities pay a set month-to-month quantity for as long as you live. And also if the annuity runs out of money, the monthly payments will certainly continue coming from the insurance provider. That means you can rest very easy recognizing you'll always have a steady revenue stream, despite for how long you live.

Oceanview Life And Annuity Complaints

While there are several different kinds of annuities, the very best annuity for lasting treatment costs is one that will pay for most, otherwise all, of the costs. There are a couple of points to think about when picking an annuity, such as the length of the contract and the payment choices.

When selecting a fixed index annuity, contrast the available items to find one that finest fits your requirements. Athene's Efficiency Elite Collection American Equity AssetShield Series Athene Agility Fixed Indexed Annuity is our leading option for tax deferment for several reasons. Delight in a lifetime income you and your partner can not outlast, offering financial security throughout retired life.

Mutual Fund Annuity

These annuities illustrate the greatest returns (hypothetically). The picture below is a snippet from my annuity to give you a far better concept of returns. There are a couple of essential variables to take into consideration when locating the ideal annuities for seniors. Based upon these criteria, our recommendation for the would be American National. In enhancement, they allow approximately 10% of your account worth to be withdrawn without a fine on the majority of their product offerings, which is higher than what most various other insurance provider permit. An additional aspect in our suggestion is that they will certainly enable senior citizens approximately and consisting of age 85, which is additionally greater than what a few other firms allow.

The very best annuity for retirement will depend on your specific requirements and goals. Nevertheless, some attributes prevail to all suitable retired life annuities. Most importantly, an ideal annuity will certainly supply a steady stream of income that you can rely on in retired life. It must likewise offer a secure investment alternative with possible growth without threat.

Monthly Retirement Checks For Life. Guaranteed.

They are and consistently provide some of the highest possible payouts on their retired life revenue annuities. While prices vary throughout the year, Integrity and Warranty are typically near the leading and maintain their retired life revenues affordable with the various other retirement revenue annuities in the market.

These rankings give consumers a concept of an insurance coverage business's economic stability and just how likely it is to pay out on cases. It's essential to note that these ratings don't always mirror the high quality of the items offered by an insurance company. For example, an "A+"-ranked insurance provider can offer items with little to no growth possibility or a lower revenue for life.

Besides, your retirement cost savings are most likely to be one of one of the most vital investments you will certainly ever before make. That's why we just suggest collaborating with an. These companies have a tried and tested performance history of success in their claims-paying capability and provide several features to aid you fulfill your retired life objectives."B" rated business should be stayed clear of at mostly all prices. If the insurance business can not achieve an A- or much better rating, you must not "bet" on its skills lasting. Surprisingly, many insurer have actually been around for over half a century and still can not attain an A- A.M. Ideal ranking. Do you desire to bet cash on them? If you're looking for life time income, stick to ensured earnings bikers and prevent performance-based revenue motorcyclists.

Table of Contents

Latest Posts

Ironworkers Annuity

Western And Southern Annuities

Best Deferred Income Annuity

More

Latest Posts

Ironworkers Annuity

Western And Southern Annuities

Best Deferred Income Annuity